Key Highlights: AI Agent for Lead Acquisition

Challenges in Lead Acquisition: Slow follow-ups, human bias, no 24/7 support

How AI Agents Solve: Instant replies, data-based decisions, faster conversions

E-commerce Lead Acquisition: Engages customers from digital ads → Qualifies Leads → Schedules a Visit (Online to Offline conversion) → Escalates to Sales Team → Post-Visit Engagement & Follow-Ups

BFSI Lead Acquisition:

- AI Lead Generation Agents for Banks: Lending Origination Agent, Financial Literacy Bots, Conversational Wealth-Advice & Micro-Investing Agent, Open AI Agent

- Insurance Lead Generation: Smart lead qualification, instant quote, retargets lost leads

Could your current lead qualification process be unknowingly leaving money on the table by missing out on the right prospects?

Lead acquisition has become tougher than ever. Everyone is chasing the same prospects with the same strategies. But in the rush, many teams still miss genuine opportunities that could bring real results.

Just look at what the numbers say:

- 74% of companies say turning leads into customers is their biggest priority

- 80% of new leads never turn into sales

- 53% of marketers allocate more than half their budget on lead generation

So, how do you get past these challenges? The answer is simple. You need smarter automation. With an AI agent for lead acquisition, you can accelerate and improve lead generation.

Why is Lead Generation So Challenging Today?

Lead generation feels tougher than ever, doesn’t it? Traditional methods often slow things down and make it harder to turn leads into customers.

1. Inconsistent Follow-Ups

When someone shows interest, they expect a quick reply. But many leads end up waiting for that call, or a message that never comes. This delay can make them lose interest or choose a competitor who responds faster.

To keep leads engaged, you need timely follow-ups. Without them, they might think you don’t value their interest and start looking elsewhere.

2. Human Bias

Even with good intentions, human-led lead qualification can create bias. Sales teams may focus on certain types of leads based on personal preference.

This means good leads might get ignored while less promising ones get more attention. That kind of imbalance can hurt your conversions.

3. Lack of 24/7 Availability

Leads don’t wait for business hours. Yet most sales teams work only during the day. This leaves potential customers browsing at night or in different time zones without help. That wait can feel frustrating, especially in fast-paced sectors like banking.

4. It’s a Slow Process

Manual lead generation takes time. From qualifying leads to answering questions, everything moves more slowly. Customers often see this delay as a red flag. They might lose patience or confidence in your ability to provide reliable service.

Are AI Agents the Ultimate Solution?

Thankfully, yes. AI agents can solve all these challenges by helping you engage leads better.

1. Instant Response & 24/7 Availability

AI agents never sleep. Whether it’s 2 PM or 2 AM, your AI agent for sales can reply instantly. It answers questions and shares personalised recommendations. This constant availability maximises customer satisfaction and helps you convert more leads..

2. Data-Driven Decisions

AI agents rely on data instead of bias. They assess lead behavior, demographics, and past interactions to qualify leads accurately. That means every lead gets the right level of attention.

3. Speed

AI agents handle leads faster than humans. They process multiple inquiries at once and qualify leads in real time. They help you move leads through the funnel much quicker.

How AI Agents Help E-Commerce Lead Generation?

1. Digital Ads Engagement

When your customer clicks on a digital ad, the AI agent starts a conversation right away. It could be a banner, social media, or search ad. The agent asks quick and relevant questions like product interest, budget, or preferred store location. This helps qualify the lead and move them to the next step in the sales funnel.

- Instant Qualification: The AI agent asks direct and focused questions to understand customer intent, budget, and preferences. It qualifies leads instantly while keeping the conversation engaging.

- Seamless Integration: The agent quickly shares lead details with the sales team or schedules a store visit for an in-person chat.

2. Schedule a Visit with Personalised Suggestions

The AI agent makes shopping more personal for every lead. It suggests products or services available at nearby stores and invites them to schedule an in-person visit.

- Personalised Visit Scheduling: Based on the customer’s choices, the AI agent recommends a nearby store. It also shares available time slots and store details to make scheduling easy.

- Tailored Recommendations: The agent gives personalised product suggestions that customers can explore in-store. This makes offline shopping more engaging and relevant.

- Offline-to-Online Conversion: It creates a smooth bridge between online ads and offline visits. This not only drives more foot traffic but also keeps customers more connected to your brand.

3. Escalation to Sales Team for In-Person Assistance

When a lead needs deeper support or has detailed questions, the AI agent brings in a human sales representative. This can happen online or at a physical store.

- Seamless Handoff: The AI agent knows when a lead needs human help. It instantly passes the qualified lead to a sales associate so no potential customer gets missed.

- Real-Time Support: The sales team gets all the information collected by the AI agent right away. This helps them offer personalised and accurate help on the spot.

4. Post-Visit Engagement & Follow-Ups

Once a customer visits the store, the AI agent follows up with them. It gathers feedback, shares product suggestions, and encourages them to come back for another visit or purchase.

- Post-Visit Feedback: The AI agent reaches out after the visit to ask for feedback. It can also offer a discount or deal to motivate the next purchase.

- Engagement with Offers: Based on what the customer did in-store, the agent sends personalized offers or reminders to keep them engaged.

Optimise E-Commerce Conversions with an AI Agent for Lead Acquisition

How Can AI Agents Transform Lead Generation in BFSI?

Banks: Streamlining Lending with AI Agents

1. Intelligent Lending Origination Agent

An AI agent identifies creditworthy customers. It runs affordability checks and creates personalised loan offers. It also collects only the needed documents and schedules KYC, simplifying the process.

- Identifies Credit-Ready Customers: The AI agent studies customer behavior and credit data to find those ready for credit.

- Personalised Loan Offers: It creates tailored loan options with product details. It creates interest rates and repayment terms that fit your customer’s needs.

- Automates Documentation and KYC: The agent collects documents and enables e-signatures. Moreover, it schedules doorstep KYC to complete applications faster.

2. Financial Literacy Bots

Want to help customers understand banking better? The multilingual bots do just that. They educate first-time customers and those new to financial concepts. It uses simple explanations and gamified onboarding experiences.

- Multilingual Education: The AI agent explains financial topics in different languages. Therefore, customers can access and understand banking services.

- Gamified Onboarding: It introduces banking through engaging, interactive activities that appeal to younger or rural audiences.

- Guides Financial Journey: The bot helps customers learn about budgeting and saving. This helps them make confident financial decisions.

3. Conversational Wealth-Advice & Micro-Investing Agent

What if wealth management could feel like a chat? This AI agent offers personalised advice based on customer goals and risk levels. It also helps users make micro-investments in mutual funds, SIPs, or insurance products.

- Personalised Wealth Management: The AI agent suggests investment options such as mutual funds, ETFs, or insurance bundles that align with customer goals and risk appetite.

- Micro-Investment Execution: Customers can invest small amounts regularly by setting up recurring payments.

- Automated Goal Setting: It helps users define their financial goals and track progress. Customers get recommendations to improve their investment plans.

4. Open AI Agent

This AI agent makes your brand visible to millions of users on the OpenAI App Store. It helps you connect with customers through conversational search. It helps you reach audiences far beyond traditional channels.

- Instant Discoverability: Your banking brand becomes accessible to over 100 million active users on the OpenAI App Store. This improves visibility and engagement.

- Conversational Search: Customers can explore your banking products like loans, digital wallets, or credit cards simply by chatting with the agent.

- Streamlined Loan Pre-Qualification: The agent pre-qualifies leads, collects consent and documents, and schedules KYC right within the chat.

AI Agents in Insurance Lead Generation

1. Smart Lead Qualification & Instant Quote

Ever wish your leads could qualify themselves? This AI agent engages potential insurance customers over chat or WhatsApp. It asks key questions, like age, dependents, or coverage needs. It instantly shares personalised insurance quotes for health or life policies.

- Speeds up the Sales Funnel: It shortens the lead qualification and quote process. It boosts sales speed by 60–70%.

- Reduces Drop-Offs: Since there’s no delay like in manual quote requests, your leads stay active and interested.

- Integrates with CRM: After qualifying a lead, it hands it over to a human agent for timely follow-up.

2. Retargeting Dormant or Lost Leads

What about leads that dropped off midway? AI agents can track those who viewed quotes or left chats unfinished. After a few days, the agent reconnects with them using friendly reminders or personalized offers.

- Revives Cold Leads: The agent automatically re-engages about 20–30% of lost leads using messages tailored to past interactions.

- Behavioural Data Personalisation: It studies customer behavior to ensure each follow-up feels relevant and timely, improving conversion chances.

Supercharge Your BFSI Lead Generation Strategy with AI Agents

TechMonk: Build & Deploy AI Agents for Lead Generation Without Hassle

TechMonk is an AI agent-powered platform that helps you automate and improve every stage of customer engagement. It takes care of everything from acquisition to retention. What makes TechMonk different is its complete marketing toolkit. It brings customer data, segmentation, personalisation, and AI-powered campaigns together in one place.

You don’t just use AI chatbots here. You use intelligent, task-oriented AI agents that can actually think and act. These agents can perceive, decide, and take action across different workflows.

Each one learns from customer behaviour, analyses results, and performs real tasks like following up, raising tickets, or closing sales. Together, they make TechMonk a complete AI capital engine for your business.

TechMonk stands out because it offers the right mix of security, scalability, compliance, and AI features. These are built specially for digital financial services.

- Inactive Account Activation: Reactivate dormant accounts with AI agent strategies. TechMonk’s segmentation tools identify inactive customers based on their behaviour. You can launch targeted re engagement campaigns for these customers. AI agents follow up, give personalised offers, and send proactive nudges to bring them back.

- Upsell and Cross Sell: Unlock new revenue with AI agent powered upsell and cross sell opportunities. TechMonk’s AI agents study customer behaviour and suggest the right products at the right time. This drives higher conversions and increases customer lifetime value.

- Customer Engagement:Build stronger loyalty with personalised engagement powered by AI agents. They share relevant content and create interactive experiences across channels. These AI agents help you build lasting relationships and strong brand loyalty.

- Customer Operations: Transform customer operations with AI agent automation. From onboarding to transaction management, TechMonk’s AI agents handle routine tasks. They remove manual effort and improve overall efficiency.

- Customer Support: Improve customer satisfaction with AI agent support. TechMonk’s AI agents offer instant help and resolve routine questions quickly. They also create support tickets automatically and pass complex issues to human agents. This ensures fast and smooth support for every customer.

TechMonk helps you create AI agents that fit your bank’s needs in just three simple steps. Would you like to see how easy it is?

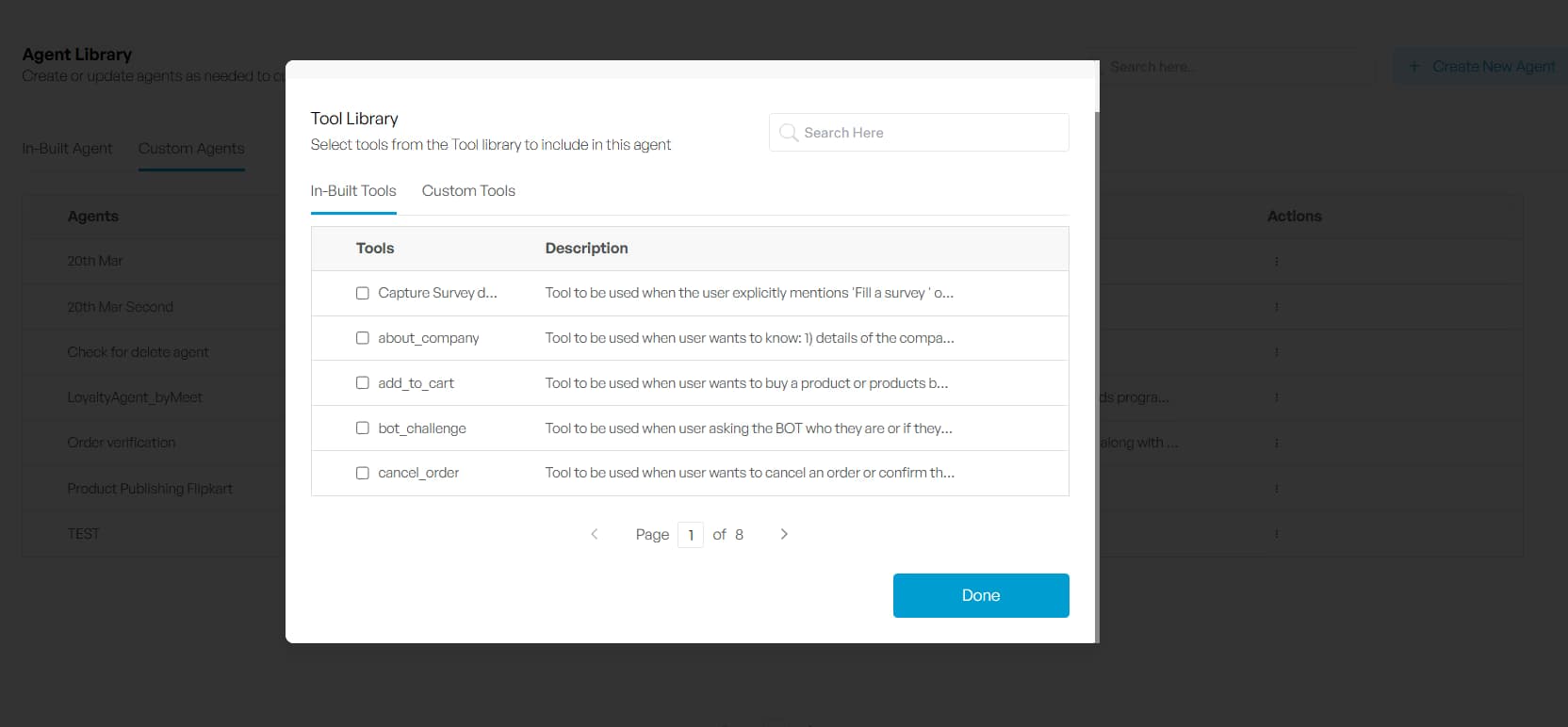

- Tools Library : Choose from our inbuilt tools or create your own. These tools give your AI agents the ability to perform any task in your workflow.

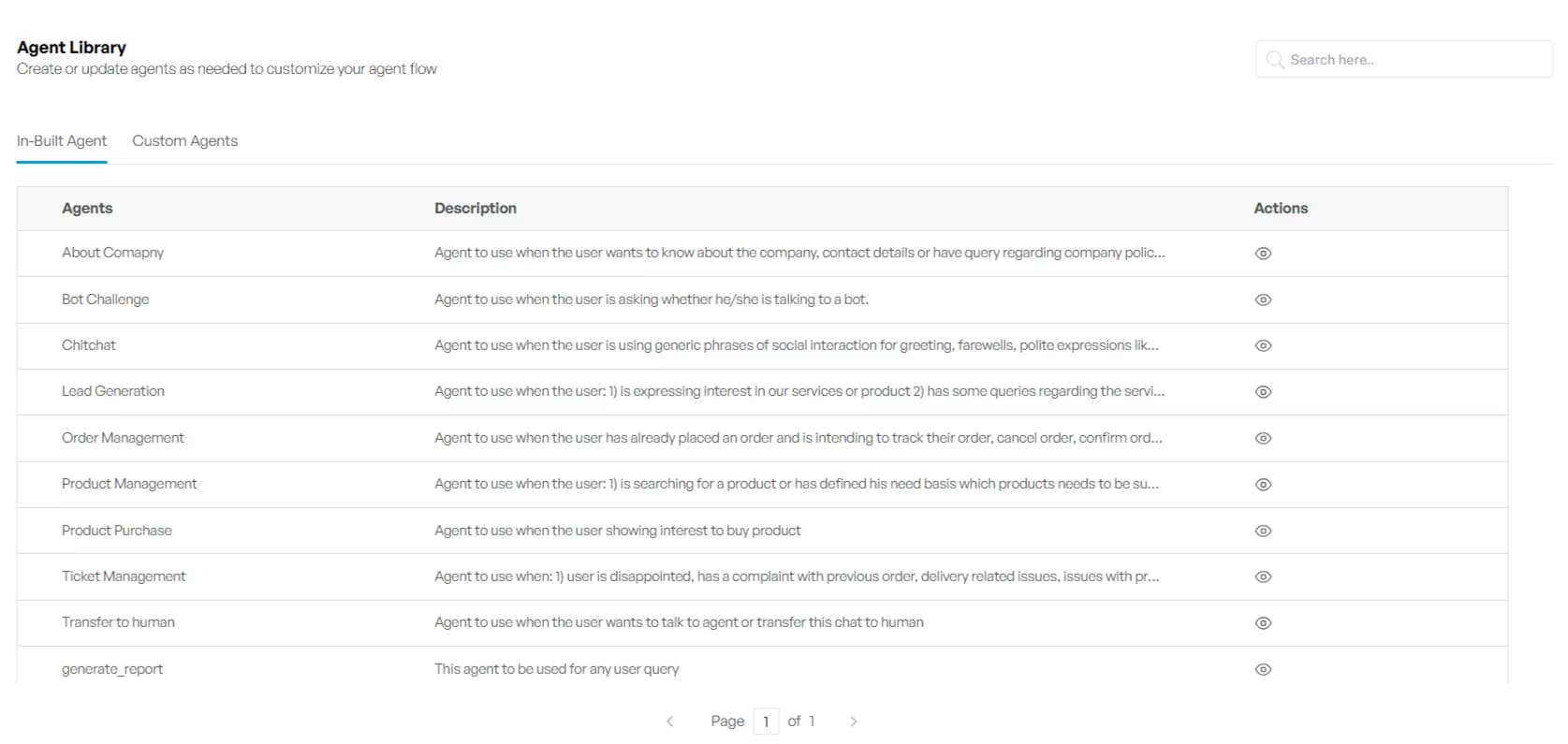

- Agents Library : Pick from our inbuilt AI agents or design custom ones. They can run on your own tools or use the pre-built options.

- Agent Flow :Automate any banking workflow with ease. Assign tasks to the right AI agents and make sure everything gets done on time. TechMonk’s orchestrator smoothly manages all task delegation for you.

With AgentMonk, TechMonk’s AI agent platform, you get full visibility into how your AI agents work. You can also train them for top performance using powerful tools that track, refine, and improve agent interactions.

- Guardrails: With AgentMonk, you can set strict guardrails to ensure your AI agents give accurate, secure, and compliant responses. This reduces risks like data misuse or wrong prompts. It also ensures high-quality customer interactions every time.

- Testing Automation: AgentMonk helps you validate AI agent responses automatically using the LLM Judge. This makes sure your agents always give reliable and relevant answers. Automation reduces manual checks and keeps your agents sharp, which improves customer experience.

- Observability of Workflows: Stay updated with real time visibility into all workflows. AgentMonk lets you see issues as they happen and fix them right away. This helps you optimise interactions and create smoother customer experiences.

- Traceability of Conversations: Track every interaction your AI agents have with customers. AgentMonk allows you to follow each conversation and understand how decisions are made. You can spot areas that need improvement, keeping communications transparent and efficient.

- Tracking AI Agent Performance: Keep track of key metrics like response time, accuracy, and latency to measure performance. AgentMonk gives you the tools to fine tune your agents and improve efficiency. This helps them respond faster and more accurately, leading to happier customers.

- Choose Prebuilt Tools or Build Custom Tools

- Choose Prebuilt AI Agents or Custom AI Agents

- Build Custom Agentic Workflows to Automate Operations

Why TechMonk’s AI Agents Stand Out?

- Customer Intelligence Platform: Build a complete 360° view of your customers. Combine profiles, financial behaviour, and engagement history to deliver smarter and more personal service.

- AI Driven Campaigns: Launch targeted campaigns with ease. Tailor offers for the right customer segments and use filters like age, location, and behaviour to boost engagement and get better results.

- Journey Builder: Design smooth and personalised customer journeys. AI helps you engage different customer segments and create experiences that feel relevant and meaningful.

Conclusion

The competition for leads keeps getting tougher every day. If you still rely on slow and manual methods, you’ll lose potential customers to others using an AI agent for lead acquisition. These businesses move faster and reply instantly.

They convert leads long before others even start following up. Why let that happen when you can stay ahead? Now is the time to act before the gap gets wider.

Adopting AI agents isn’t just a choice anymore. It’s what helps you stay competitive in the market. With TechMonk, you get the right tools to build powerful AI agents. You can automate your complete lead generation process with ease.

So, don’t wait. Book a call with TechMonk today and transform how you acquire leads.

FAQs

What is an AI agent for lead acquisition?

How does an AI agent help in generating leads?

Can AI agents qualify leads automatically?

What industries can benefit from AI lead acquisition agents?